The vast majority of financial institution sector outlooks remain neutral despite the significant deterioration in the global macroeconomic outlook this year, Fitch Ratings says, following a mid-year review. Most bank, non-bank financial institutions (NBFI) and insurance sectors still show steady credit fundamentals, but risks are skewed to the downside, particularly in emerging markets.

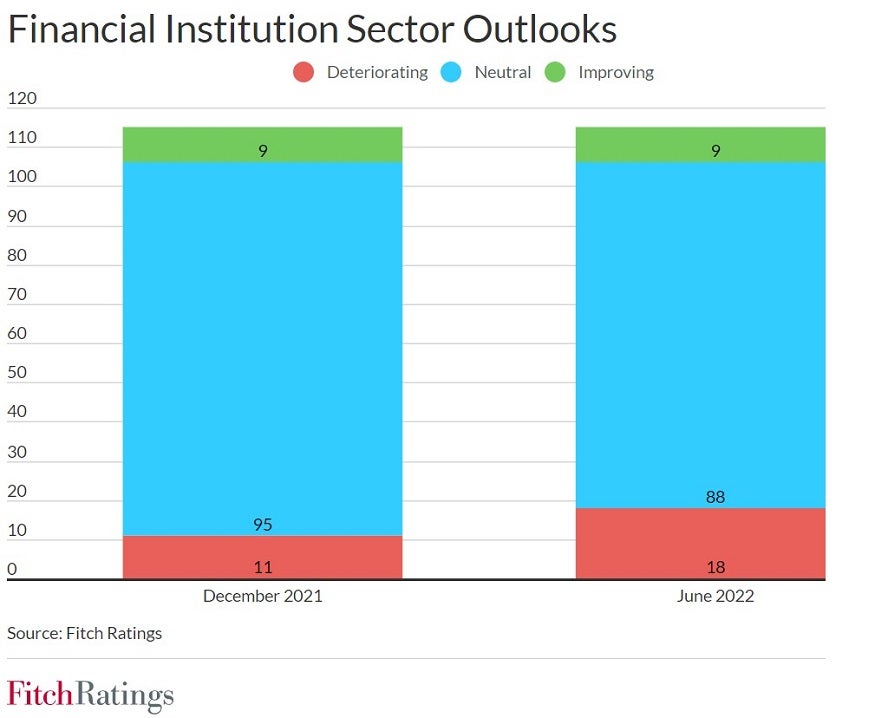

Of 115 financial institution sector outlooks, 88 are neutral following our review, compared with 95 in December 2021, when we last carried out a full review. There are now 18 deteriorating sector outlooks, compared with 11 in December 2021.

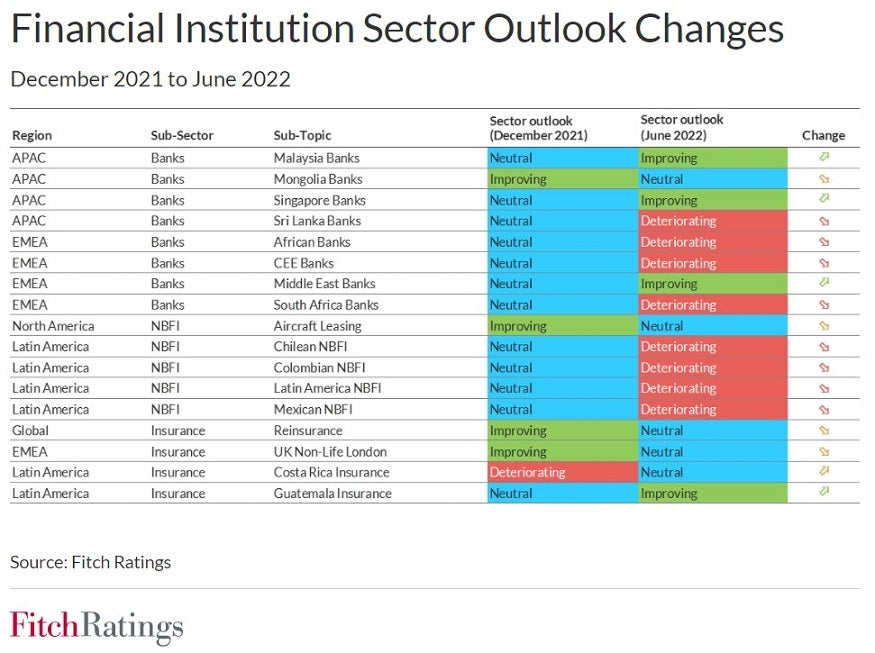

Our review led to 12 sector outlooks moving downwards to deteriorating from neutral or to neutral from improving, with five moving upwards.

Financial institutions around the world are facing weaker operating environments due to slowing GDP growth and high inflation, which are putting pressure on their customers’ finances. Emerging markets are particularly affected. However, rising interest rates should benefit lenders’ net interest margins and insurers’ investment yields, helping to support credit quality.

For bank sectors, the prevalence of neutral outlooks belies a significant change in operating environments. The economic outlook is more uncertain than it was six months ago, and downside risks are increasing, particularly for emerging-market economies, which could suffer from capital outflows and tighter liquidity due to weakening investor sentiment. The sector outlook for African banks is now deteriorating, as is that for central and eastern European banks, whose operating environment is highly exposed to the war in Ukraine.

We expect banks in most markets to experience moderate asset quality deterioration in 2H22, but credit quality should be supported by improved margins due to rising interest rates. Accumulated loan-loss allowances and robust capital buffers will also support credit quality. However, a global economic recession, which is not our base case, would lead to greater asset-quality deterioration.

NBFI sector outlooks are also predominantly neutral. We expect credit quality to remain supported in most cases by strong financial profiles, including modest leverage, improved funding and liquidity, and limited sensitivity to interest rate rises. A notable sub-sector where we lowered the outlook is aircraft leasing. The outlook was previously improving, reflecting our expectation of a post-pandemic recovery for aircraft lessors. However, we have now revised the outlook to neutral in light of multiple knock-on effects from the war in Ukraine conflict that could delay the recovery, including high oil prices, reduced air traffic, and impairments of unrecoverable aircraft that may not be fully covered by insurance.

Most insurance sector outlooks are neutral, reflecting steady fundamentals. Higher interest rates will release some of the long-standing pressure on life insurer earnings and spreads, despite related declines in fixed-income investment market values, and greater financial market volatility in general.

However, non-life insurers and reinsurers face rising claims inflation. They may be able to increase premiums accordingly, and higher interest rates could boost investment income, but reserve deficiencies could start to arise on long-tail business lines as high inflation becomes longer-lasting. We lowered the global reinsurance and London market sector outlooks to neutral from improving in April 2022, reflecting increased risks from rising claims inflation, financial market volatility and weakening price momentum.

Our 2022 mid-year outlook reports for banks, NBFIs and insurers are available at www.fitchratings.com or by clicking the links below:

Fitch Ratings 2022 Mid-Year Outlook: Global Banks

Fitch Ratings 2022 Mid-Year Outlook: Global Non-Bank Financial Institutions

Fitch Ratings 2022 Mid-Year Outlook: Global Insurance