Leading UK banks have surpassed their Western European counterparts in pre-tax profits, according to recent analysis. Figures indicate that UK banks contributed 18.93% of the total pre-tax income among the top banks in Western Europe.

In comparison, banks in France, Spain, Italy, and Germany generated 16.7%, 12.96%, 8.6%, and 6.24% respectively.

The data encompasses profits from the UK’s prominent “big six” banks, including Barclays, HSBC, Lloyds, Nationwide, NatWest, and Santander. It also includes 20 additional British organizations within The Banker’s Top 1000 global banks.

In 2022, UK banks recorded aggregate pre-tax profits (PTP) of $52.7 billion (£41.1 billion), surpassing France’s $46.5 billion. The Top 1000 list, which ranks banks based on their Tier 1 capital, reflects their financial strength.

Notable institutions on the list include HSBC, ranking highest among British banks, and others such as the Close Brothers Group.

Despite declines in Tier 1 capital among the big six UK banks in 2022, resulting in five banks dropping in the main Top 1000 ranking, the UK banks have still generated more profit than their European rivals.

The Banker attributed the decline to the strong US dollar, as most UK banks report in pounds sterling, except for HSBC and Standard Chartered, which report in US dollars.

Among UK banks, HSBC emerged with the highest pre-tax profit figure of $17.5 billion, followed by Barclays at $8.4 billion and Lloyds Banking Group at $8.3 billion.

However, each of these banks experienced a decline in pre-tax profits compared to the previous year. Notably, Nationwide witnessed the largest increase among the major banks, with profits rising by 86% to $0.2 billion.

This comes at a time when banks are facing increased scrutiny for not passing on higher savings rates to consumers.

In response to rising interest rates, the Bank of England increased its base rate from 0.1% to 5% since December 2021. Mortgage interest rates, meanwhile, have surged to the highest levels seen in over 15 years.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHowever, savings rates have not experienced a corresponding increase. Analytics company Moneyfacts reveals that in June, the average easy-access savings account paid a rate of 2.32%, while the average standard variable rate mortgage (SVR) stood at 7.52%.

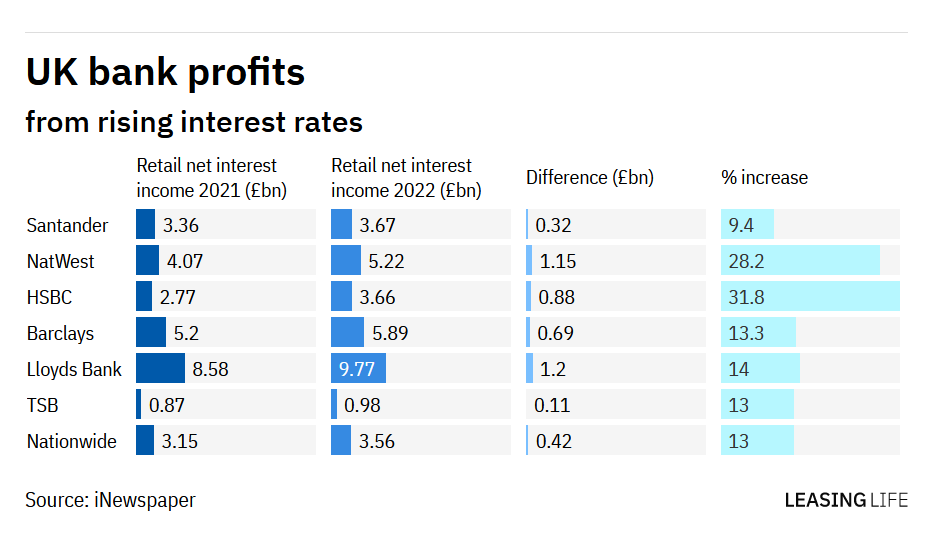

The Treasury Committee of MPs recently questioned financial executives regarding their treatment of savers with the current savings rates. An earlier analysis by the Banker found that major lenders collectively generated £4.8 billion in additional profits during 2022 due to rising interest rates.

HSBC, the top-ranked UK bank in The Banker’s Top 1000 list, noted that it had increased savings rates multiple times since the beginning of 2022, including recent adjustments.

Nationwide, the member of the big six with the highest profit increase, stated that it was still considering its response to the latest Bank Rate change and would announce any changes in due course.

Raiffeisen postpones quitting Russia