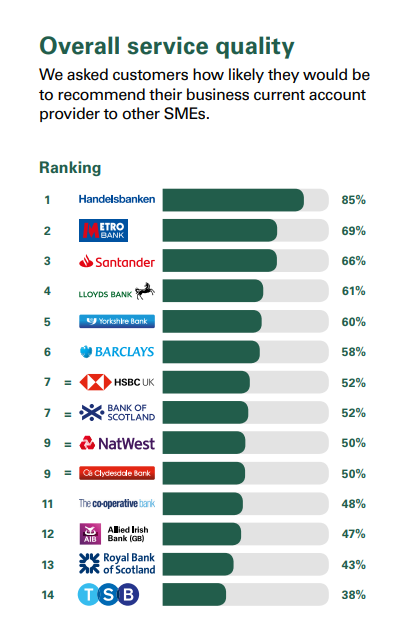

The third set of banking customer satisfaction results from the Competition and Markets Authority (CMA) has shown Handelsbanken topping tables in the business banking sector for the second consecutive year.

In the business banking sector, customers were asked how likely they would be to recommend their provider’s SME overdraft and loan services to other SMEs. Sweden headquartered Handelsbanken scored top, with 81% of respondents responding positively. Santander, Bank of Scotland, HSBC and Yorkshire Bank tied with Lloyds made up the rest of the top five. TSB, which has been plagued by intermittent IT crises in the past year, finished bottom with just 46% of respondents recommending them.

Customers were also asked how likely they would be to recommend their provider’s account management to other SMEs. Handelsbanken again finished top with 89% of customers recommending them, and TSB was again bottom, with only 37% of their customers recommending them.

On the question of how likely customers would be to recommend their provider’s branch and business center services to other SMEs, Handelsbanken was top with 78% of positive feedback, while RBS and Allied Irish Bank were joint bottom on 38%.

These measures were introduced by the Competition and Markets Authority (CMA) after it conducted a market investigation into the retail banking sector in 2016. It aims to give people better quality information about their provider, the services on offer within the sector and therefore help them choose one most suited to their needs.

The results of the independent survey are displayed in a ‘league table’ style and, since its introduction in August 2018, providers have been required to prominently display them both in branch and on their websites and apps.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThey are intended to clearly show customers how their provider ranks on quality of service and make it easier for people to compare offers.

Adam Land, senior director at the CMA, said: “Current account holders and small businesses should consider voting with their feet and switching their bank or building society if they aren’t getting a good service. These league tables help show what’s out there for customers and hold the providers to account. There’s nowhere for the worst performers to hide now.

“We also welcome the expansion and reach of the survey with the addition of new participants from the personal banking sector in 2019 and 2020.”

In addition, current account providers are required by the Financial Conduct Authority (FCA) to publish details of available services and relevant helplines, as well as figures on how long it takes to open current accounts and replace debit cards, and information about the number of major operational and security incidents they have experienced.

Christopher Woolard, executive director of strategy and competition at the FCA, said: “It is now a year since we required firms to start publishing this data, providing people with the tools to work out how easily they can carry out day to day banking activities, as well as the reliability of the service they receive.

“The figures provide a more established basis for consumers, small businesses and comparison services to compare current account providers and find the right solution for their needs. The information published should increase the incentive for firms to offer better service, helping consumers to get the most out of their banking experience.”

Last month the CMA directed Barclays to improve its practices after the bank broke rules designed to protect small businesses.

Participating providers in the survey were Allied Irish Bank (GB), Bank of Scotland, Barclays, Clydesdale Bank, Handelsbanken, HSBC UK, Lloyds Bank, Metro Bank, NatWest, Royal Bank of Scotland, Santander UK, The Co-operative Bank, TSB, and Yorkshire Bank. Approximately 1,200 customers a year are surveyed across Great Britain for each provider; results are only published where at least 100 customers have provided an eligible score for that service in the survey period.

Graphics: BDRC / Competition Markets Authority