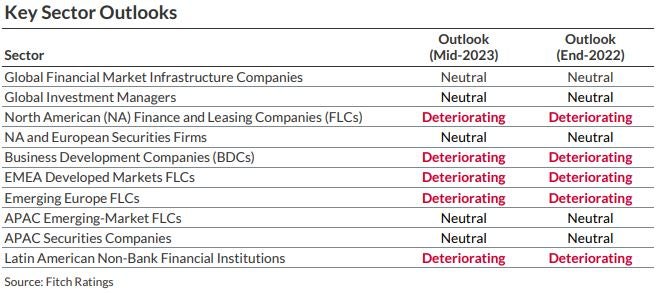

Fitch Ratings’ mid-year 2023 sub-sector outlooks for global Non-Bank Financial Institutions (NBFI) remain unchanged from end-2022, according to the rating agency.

Half of Fitch’s 10 NBFI sub-sector outlooks are still ‘deteriorating’. These five sub-sectors are related to finance and leasing companies, which are more directly affected by rising interest rates, inflation, and mild recessionary conditions, in terms of funding costs, growth prospects and asset quality dynamics, Fitch said in a statement.

NBFI

The other half of Fitch’s NBFI sub-sector outlooks remain ‘Neutral’, and are primarily related to balance-sheet-light business models, which are less directly sensitive to macroeconomic conditions while continuing to benefit from robust market volumes. Market volatility is increasing revenues in brokerage and wealth management for securities firms in all regions.

Global financial market infrastructure companies are also benefiting from higher trading volumes. Amongst global investment managers, alternative investment managers are more resilient than traditional investment managers given their more stable fees (charged based on committed capital) and assets under management (not subject to near-term redemptions), Fitch said.

Nathan Flanders (pictured), Global Head of Non-Bank Financial Institutions at Fitch Ratings, said: “Rising interest rates and inflation remain sector headwinds, particularly in terms of funding costs and growth opportunities. However, mild recessionary conditions have allowed asset quality to remain fairly resilient thus far, limiting the magnitude of potential rating implications.”

Belarus leasing sector under pressure in 2023

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData