Leasing companies are harming the transition to electric cars through their high pricing and weak zero-emission targets, a study by Transport & Environment (T&E) has found.

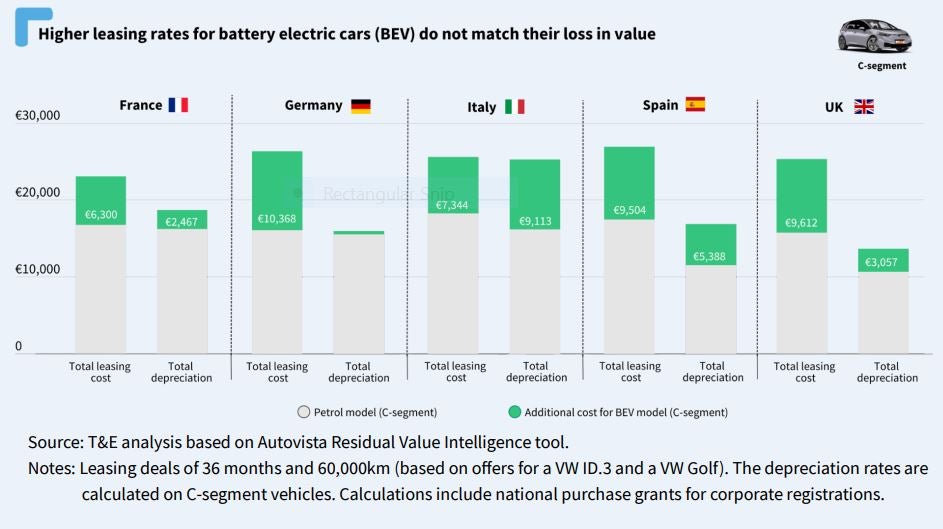

Leasing deals for battery electric vehicles (BEVs) are overpriced, an analysis by T&E of the used car market has found.

In Europe, leasing deals for BEVs are, on average, 57% more expensive than their equivalent petrol models. For example, leasing an electric Peugeot 208 costs approximately €574 a month, whilst the petrol Peugeot 208 is €371.

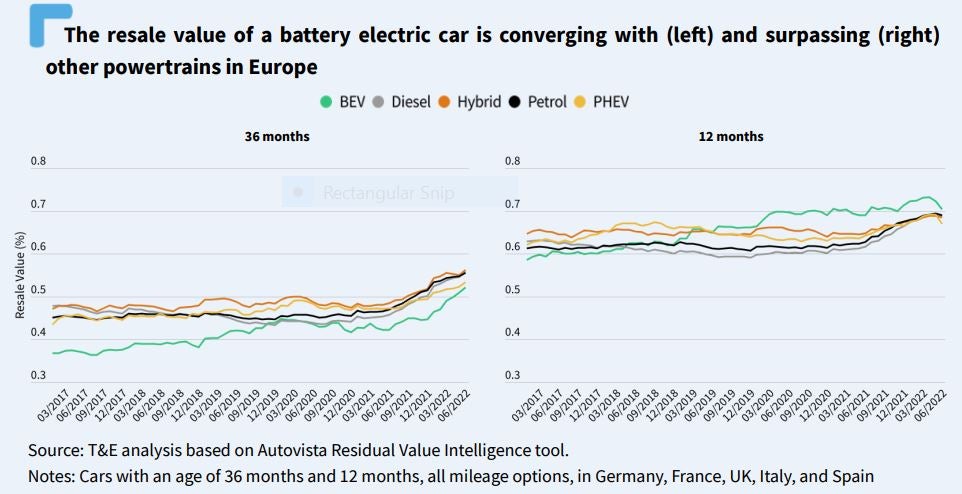

However, according to T&E analysis, BEVs have similar resale value to diesel and petrol vehicles.

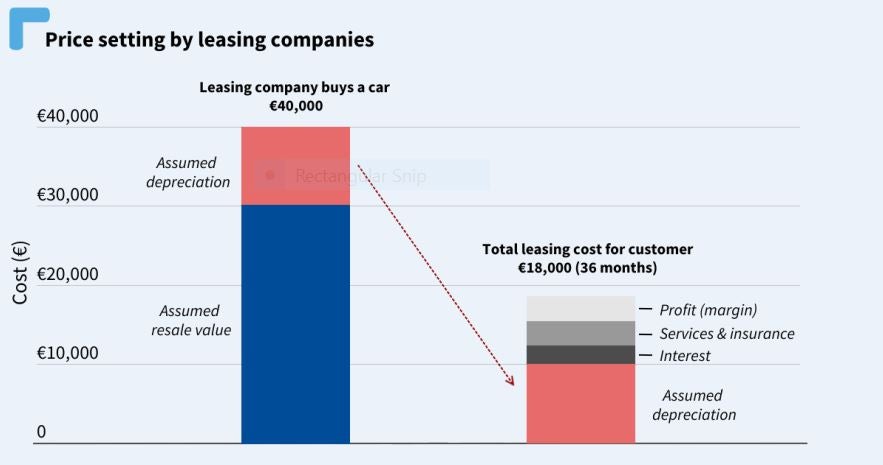

Leasing companies typically charge customers for the expected loss in value of a vehicle over a three to four-year lease, so higher lease prices mean they expect BEVs to lose more of their value. But this is no longer the case.

The higher leasing prices for battery electric cars are unjustified. T&E analysis of 2.7 million used car prices has revealed that BEVs do not depreciate more steeply than other types of cars. Depreciation for BEVs in Europe’s biggest markets (Germany, France and the UK) is on par with diesel and petrol. In Spain, there is still a difference, but the gap is closing.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe study found that BEVs keep more of their value over time, reflecting consumer confidence in newer models with improved technology. Consumer demand for BEVs, new and used, is at an all-time high.

Stef Cornelis, director of electric fleets at T&E, said: “Today, customers are being overcharged by leasing companies if they want to switch to a battery electric car. Leasing firms are too conservative when setting their monthly prices. Their rates reflect the state of play from five years ago. With this pricing strategy, their profits are obviously high and consumers are overpaying to go electric. At the same time, they are harming the BEV transition.”

Leasing companies – with a fleet of 12 million vehicles in Europe – have an outsized role to play in the transition to battery electric cars.

In 2022, they accounted for 22% of new car registrations in Europe, the study found. Leasing companies are often owned by banks and car manufacturers, such as Lloyds Bank (Lex Autolease), Société Générale (ALD), BNP Paribas (Arval), Volkswagen (VW Financial Services), and Mercedes-Benz (Athlon).

EV targets?

None of these leasing companies has a target to become fully battery-electric by 2030. The ‘EV’ targets they have set are weak and include plug-in hybrids (PHEVs) – whose CO2 emissions are on par with petrol and diesel cars. Their commitments are far behind market dynamics as large carmakers have already committed to 100% battery electric by 2030.

As a result, the leasing sector is not leading on the BEV transition. The study found that in France and Spain, BEV uptake in the leasing sector was lower than in other corporate fleets and even private households. The UK stands out as an exception where the leasing sector is leading the BEV transition with a BEV uptake of 34%.

Cornelis concludes: “These giants of the auto world have gone unnoticed and are slipping through the cracks. Looking at their weak targets for BEVs, leasing companies are climate laggards and not green leaders.

“Unless they rapidly accelerate their electrification plans, we will struggle to supply a second-hand market that will make BEVs affordable to far more people and we further delay the decarbonisation of the transport sector.”

T&E is a non-profit organisation that receives funding from the Climate Imperative Foundation, The European Climate Foundation, Schwab Charitable Fund, the European Commission, Quadrature Climate Foundation, and the Norwegian Agency for Development Cooperation, amongst other organisations.