The Chancellor has unveiled a budget to kickstart the economy, almost a year to the date when the first of a series of government-imposed Covid-19 lockdowns of the economy began to be felt across the UK.

Rishi Sunak announced a six-month extension to emergency schemes for the business community, including an extension to the furlough scheme (which will see the government continue to foot 80% of workers’ wages) and a series of capital investment “super deductions” that one expert has questioned may potentially favour sale & leaseback arrangements but with no funding provision in place for lessees to fund the initial investment.

Also, stealing from Labour’s 2019 manifesto, the Chancellor included a future hike in corporation tax (from 19% currently) to 25% from 2023, the first such tax rise in 47 years. Some observers said the hike will likely affect one in 10 businesses.

Capital investment ‘super-deductions’

The Chancellor offered businesses a “super deduction” over the next two years, allowing firms to reduce their tax bill based on how much they invest.

Companies investing in qualifying new plant and machinery will receive a tax cut worth 130% of investments made between 1 April 2021 and 31 March 2023, amounting to a subsidy, with the government in effect paying companies to invest their capital.

The deduction is estimated to be worth approximately £25bn over two years to businesses.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataUnder this measure, investments in main-rate assets will be relieved by a 130% super-deduction, whilst investments in assets qualifying for special-rate relief will benefit from a 50% first-year allowance.

The government said it will introduce legislation in the Spring Finance Bill 2021 alongside amendments to the Capital Allowances Act 2001.

Under the terms proposed, certain expenditures will be excluded (such as for the purchase of used and second-hand assets).

The government also proposed that: “plant and machinery expenditure which is incurred under a hire purchase or similar contract must meet additional conditions to qualify for the super-deduction and special rate relief.”

A policy paper issued by HMRC, entitled New temporary tax reliefs on qualifying capital asset investments from 1 April 2021, specifies that, to qualify for:

- the super-deduction

- the 50% first-year allowance; or

- the purposes of a ring-fence trade;

The expenditure in question cannot include, among other limitations, “expenditure on cars and on the provision of plant and machinery for leasing”

The document later adds:

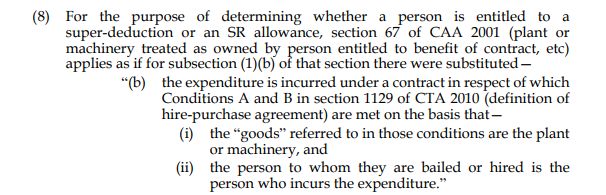

“Sub-section 8 amends section 67(1)(b) by substituting it with Conditions A and B in section 1129 Corporation Tax Act 2010 for the purpose of determining whether a person is entitled to first-year allowances in respect of the 130% super-deduction for main rate plant and machinery and 50% first-year allowance for special rate expenditure. This applies to hire purchase and similar contracts, where possession of plant or machinery transfers to the acquirer but not ownership.”

New temporary tax reliefs on qualifying capital asset investments from 1 April 2021 (Explanatory Note)

Julian Rose, the director of Asset Finance Policy, has questioned if the wording in the proposed legislation includes a provision for sale & leaseback.

Rose explains that while it is usual for such allowances not to be available to lessors, they do generally apply to lessees using hire purchase, however, what is less clear is an extract in the draft legislation that refers to “the person to whom they are bailed or hired is the person who incurs the expenditure” which might describe sale and leaseback arrangements, but “it’s unclear,” he said.

If this is the case, he asks, “could this lead to a massive shift to sale and leaseback? But how will SMEs fund the initial investment, will there need to be parallel short-term loans?”

However, the initial response from the Finance & Leasing Association to the Budget identified no such issues.

Stephen Haddrill, the FLA’s director-general, welcomed the “Chancellor’s support for an investment-led recovery” and added: “We also note that the super deduction capital allowance scheme will include plant and machinery acquired on asset finance – an extremely useful measure as leasing and hire purchase are the products of choice for more than a third of the UK’s total investment in equipment, plant and machinery and purchased software.”

In a clarification, the FLA said: “Our understanding is that the wording does not include a provision for sale and leaseback, it is for hire purchase arrangements only as defined in section 1129 of the Corporation Tax Act (2010).”

Regarding the reference in the draft legislation to: “the person to whom they are bailed or hired is the person who incurs the expenditure,” the FLA said: “Our reading of this extract is that “the person who incurs the expenditure” refers to the person making the hire purchase payments.”

“Of course, we are liaising with HMRC to seek further clarification on all aspects of the new scheme to ensure our members are fully informed,” a spokesperson for the FLA said.

Annual Investment Allowance

Also, as announced in November, the government said it would extend by one year (ending 31 December 2021) the temporary £1m limit for the Annual Investment Allowance.

The change will benefit businesses investing more than £200,000 in plant and machinery this year.

The government said AIA is not available for certain capital expenditure on plant and machinery and the exceptions are set out in Section 38B of the Capital Allowances Act 2001, the main one being expenditure on cars.

CBILS 2.0

Under the auspices of the Brtish Business Bank, the Recovery Loan Scheme will launch on 6 April 2021, following the closure of the current emergency schemes – the Coronavirus Business Interruption Loan Scheme (CBILS), the Coronavirus Large Business Interruption Loan Scheme (CLBILS) and the Bounce Back Loan Scheme (BBLS) – on 31 March 2021.

Under the scheme, UK businesses of any size will be able to apply for a loan or overdraft between £25,000 and £10m until the end of 2021.

The scheme will also cover asset finance and invoice finance between £1,000 and £10m.

All of the facilities will come with an 80% government guarantee. Finance terms are up to six years for term loans and asset finance facilities. For overdrafts and invoice finance, terms will be up to three years.

The new scheme can be used for any legitimate business purpose, including managing cashflow, investment and growth.

Catherine Lewis La Torre, Chief Executive, British Business Bank, said: “The Chancellor has confirmed the British Business Bank’s central role in the next phase of the UK’s economic recovery from Covid-19. As businesses begin to plan for the post-Covid period, they will need targeted finance to support them.

“We welcome today’s announcement of two new schemes, one to provide debt finance to a broad range of businesses, and the other to invest equity alongside the private sector in fast-growing innovative firms. Both schemes will help drive the innovation and growth needed to support the UK’s long-term prosperity.”

Auto finance

The Chancellor announced that fuel duty will remain unchanged at 57.95p per litre, which means that the tax will remain unchanged for the 11th year in a row.

Vehicle Excise Duty will increase in line with RPI inflation from 1 April 2021.

Tax rates will also increase for older cars, depending on emission rates.

Drivers with an EV company car will have to start paying Benefit in Kind tax from this April with an increase to one per cent (from zero), rising to two per cent in 2022.

Gerry Keaney, chief executive of the British Vehicle Rental and Leasing Association (BVRLA), said: “Today’s announcement will help BVRLA members and their customers to bounce-back from the economic impacts of the COVID pandemic and focus on decarbonising their fleets.

Motoring tax updates were limited to a further 12-month suspension of the HGV Levy, freezes in fuel duty and HGV Vehicle Excise Duty (VED) and inflation-linked increases in car and van VED and the fuel and van benefit charges.

“We are disappointed that the Government has given no further indication of the longer-term motoring tax roadmap it will use to drive decarbonisation, but there is lots of consultation going on and we expect more news on this in the coming months,” added Keaney.

Ashley Barnett, head of fleet consultancy at Lex Autolease (Lloyds Banking Group), said: “An alternatively-fuelled future simply can’t happen overnight.

“The affordability of EVs is a key barrier towards mass adoption and for some people, an ICE vehicle remains their only option. Against the backdrop of the pandemic, many people are still using cars as a safer mode of transport and any rises would feel counterproductive at this moment in time.

“As momentum continues to shift away from petrol and diesel, a future rise in the 10-year fuel duty freeze feels inevitable and will help fund investment in greener alternatives.”