Global ESG investment could reach $50 trillion by 2025 according to a recent estimate by Bloomberg Intelligence.

Meanwhile, for the US market, the International Energy Agency (IEA) predicts that, on average, through 2030, $4.3 trillion annually will be needed for all decarbonisation technologies and $300 billion to $500 billion will be required for breakthrough decarbonisation technologies, writes Patricia Voorhees, a director at the Alta Group. See Why climate equipment finance has immense potential.

But what is ESG? Sure, we all know what the acronym stands for, but what defines a project as being in this category or not meeting the criteria? And how are funders and investors to know what counts as ESG and what falls short?

What is a green asset?

This question was astutely identified by Lucrezia Zito, Strategy Execution Lead Sustainable Finance, ABN AMRO Asset Based Finance, during an address to delegates from around Europe gathered for the Sustainable Finance Summit 2023 in Paris on 10 May, urging delegates: “We need a common definition of ‘what is a green asset?'”

Her question raises an important point. Currently, there is no common definition, which means companies who want to get in on the act are free to slap a sustainable stamp on virtually anything they decide is vaguely green, which leaves the classification of assets open to the vagaries of overly zealous marketing managers and to claims of greenwashing.

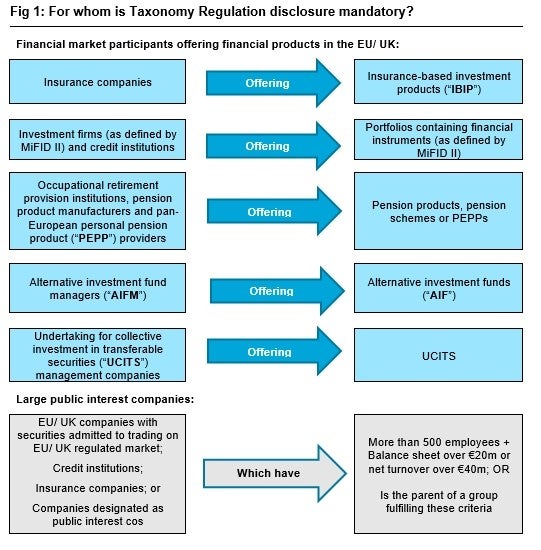

Another speaker at the conference, Ivan Bagaliyski, Strategy Director, Solifi, suggested the logic behind EU taxonomy – an EU-wide classification system for sustainable activities – could be extended or adapted to assets. We hope to follow up on this conversation as part of our green assets coverage.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAn article by White & Case LLP from August 2020, published to coincide with the taxonomy coming into force, looks at The EU Taxonomy: the answer to the question “what is green?”

What are sustainable activities?

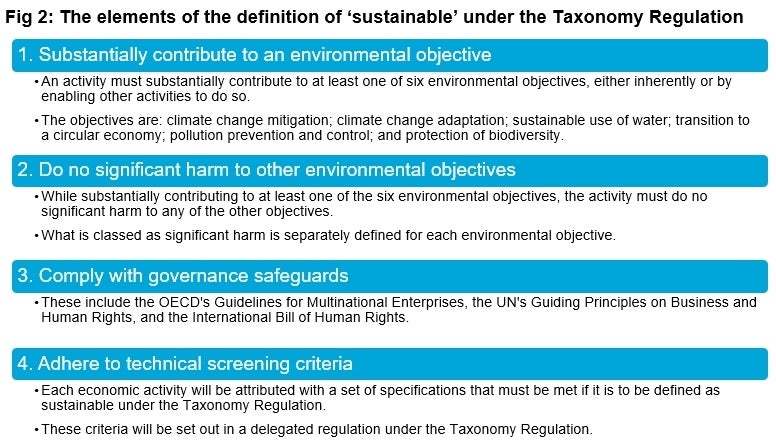

The authors write:

“Firstly, the activity must substantially contribute to at least one of six environmental objectives set out in the Taxonomy Regulation: climate change mitigation, climate change adaptation, sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control, and the protection and restoration of biodiversity and ecosystems.

“Secondly, the activity must not do any significant harm to the other environmental objectives. Thirdly, the activity must comply with minimum social and governance safeguards. Finally, the activity must comply with certain ‘technical screening criteria’.”

Leasing Life will be exploring what makes assets green this year, if you have a contribution to make, do get in touch.

Also see related: Sustainable Finance Summit 2023, Paris: setting the scene and Who will (asset) finance the climate-action revolution?