Two Covid-19 schemes for SMEs launched in the early months of the coronavirus pandemic – CBILS and BBLS – are continuing to be accessed evenly across the UK, according to newly released data from the British Business Bank (BBB).

The Coronavirus Business Interruption Loan Scheme (CBILS) and the Bounce Back Loan Scheme (BBLS) were launched to provide financial support to businesses across the UK that are losing revenue and seeing their cashflow disrupted, as a result of the Covid-19 outbreak. The schemes are in the process of being wound down and will soon end for new applications, with CBILS closing at the end of November. BBLS will close to new applications at the start of November.

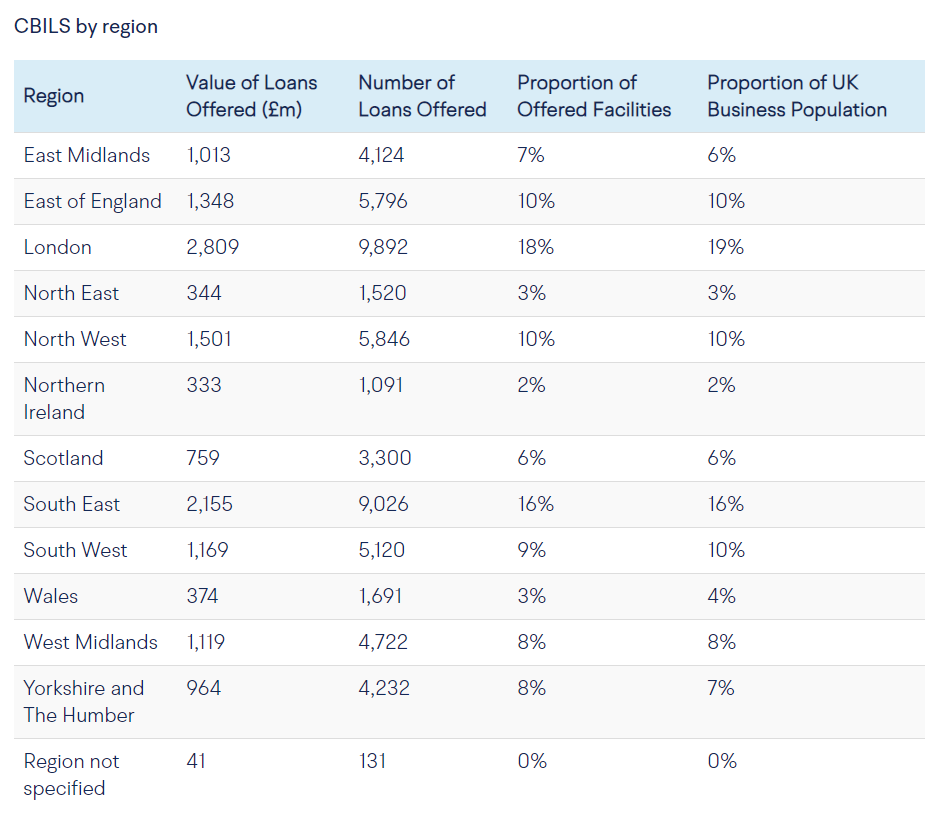

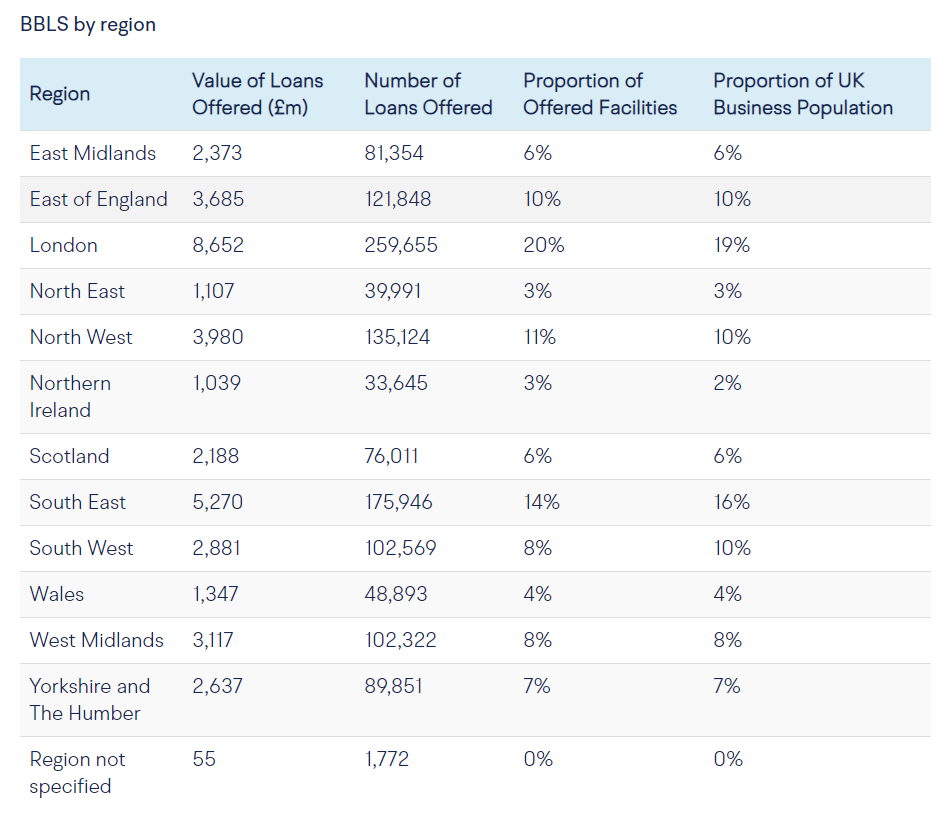

Regional data

The second set of regional and sector lending data, released by the BBB, shows a continuing pattern with the proportion of the schemes’ loans in each of the nine English regions and three Devolved Nations matching closely their respective share of the UK business population.

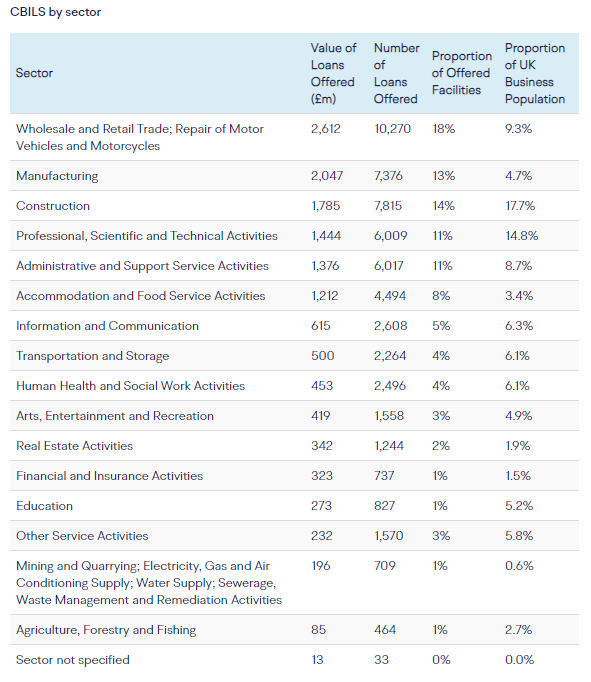

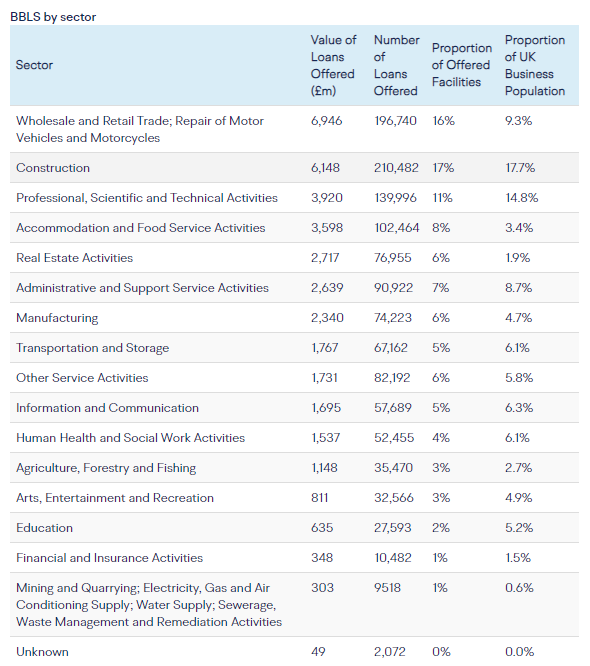

Sector data

The Wholesale and Retail sector has accessed a significantly higher proportion of CBILS loans (16%) than its share of the business population (9.3%), with Manufacturing (13% v 4.7%) and Accommodation and Food Services (8% v 3.4%) following a similar pattern.

The Wholesale and Retail sector also accessed a relatively high proportion of Bounce Back Loans compared to its business population share (16% v 9%), as did businesses in Accommodation and Food Services (8% v 3.4%) and Real Estate Services (6% v 1.9%).

British Business Bank

Patrick Magee, chief commercial officer, BBB, said: “The British Business Bank is committed to identifying and helping reduce regional imbalances in access to finance for smaller businesses across the UK.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“It is, therefore, encouraging that the data shows a continued benefit to well over a million smaller businesses spread across the whole country, helping them with much-needed emergency finance so they are better placed to survive, stabilise and prepare for future growth.”