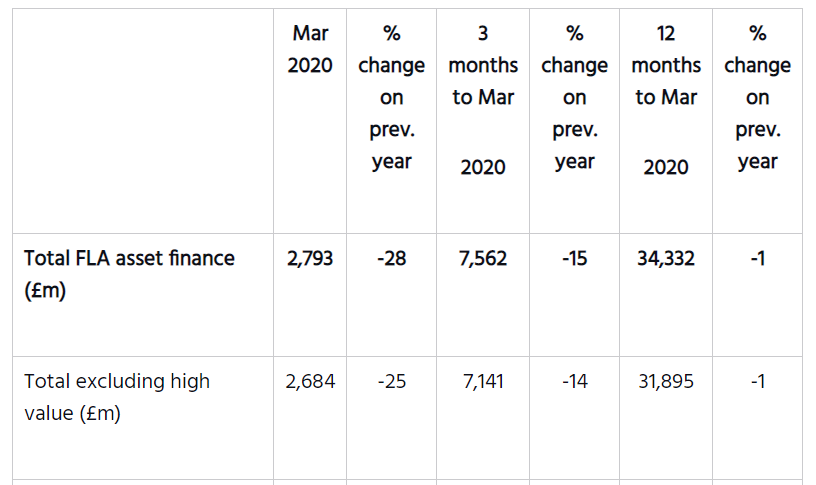

Total asset finance new business (primarily leasing and hire purchase) fell by 28% in March 2020 compared with the same month in 2019, according to figures released by the Finance & Leasing Association (FLA).

In Q1 2020 as a whole, new business fell by 15% compared with Q1 2019.

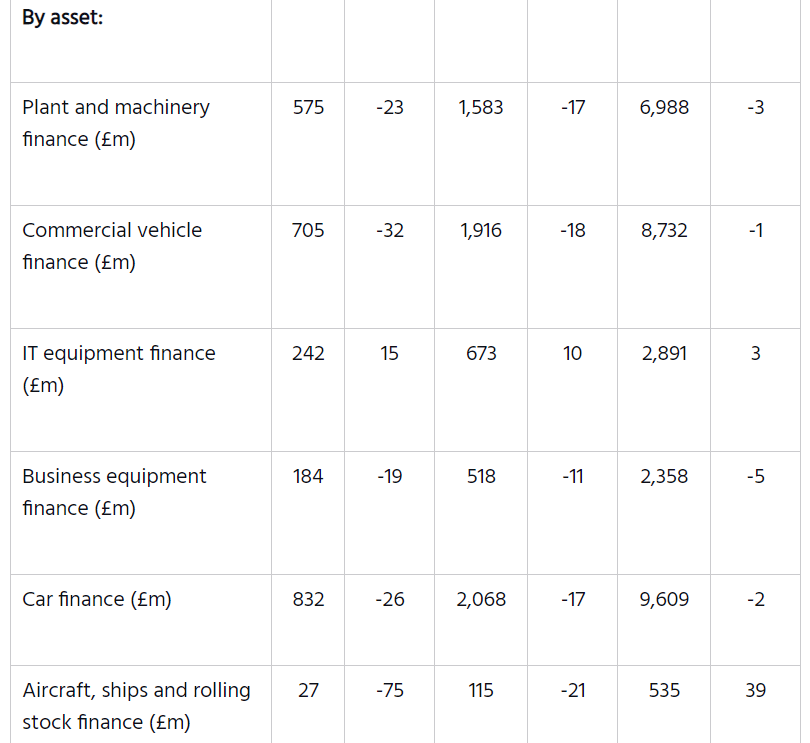

The IT equipment finance was the only asset sector to report growth in March, with new business up by 15% compared with the same month in 2019.

Over the same period, the commercial vehicle finance and plant and machinery finance sectors reported falls in new business of 32% and 23% respectively.

Geraldine Kilkelly, head of research and chief economist at the FLA, said:

Geraldine Kilkelly, head of research and chief economist at the FLA, said:

“The asset finance market was hit hard in March by measures taken by the Government to deal with the coronavirus crisis.

“Of particular concern is new lending to SMEs which contracted by 19% compared with March 2019, and by 10% in Q1 2020 as a whole.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“FLA asset finance members provided £20.1bn of new lending to SMEs in 2019, of which £7bn came from non-bank lenders.

“We continue to urge the Government to provide support for non-bank lenders by allowing them to access the Term Funding Scheme.

“This would ensure that a diverse, innovative and competitive business lending market remains in place to help the economic recovery.”