In the US, 52% of private companies have either already adopted or are starting to implement lease accounting rules delayed by Covid-19, according to LeaseAccelerator, a provider of lease accounting software.

LeaseAccelerator said that a new accounting standard places the onus on businesses “to create, implement and sustain lease accounting compliance plans that harness processes, technology, and people.”

As part of its 2022 Global Lease Accounting Survey conducted with Ernst & Young (EY), it found that:

- 20% of US private company respondents are starting implementation, and 32% have already implemented by adopting early, up by a factor of 8 from last year.

- 40% of respondents say that they return less than 70% of their leases on time.

- Although 37% of respondents have more than 250 leases, most are not centralising decision-making and automating processes.

- Nearly half (48%) of respondents said their lease accounting is not fully integrated with ERP (enterprise resource planning) systems, creating potential missed opportunities for business optimisation.

ASC 842, published by the Financial Accounting Standards Board (FASB), the US body that sets accounting rules, was first suggested in February 2016. Around this time, a similar change to accounting standards arose with the International Accounting Standards Board (IASB) resulting in IFRS 16, which applies to companies operating in the UK and northern Europe. For IFRS 16 and ASC 842 differences and considerations visit HERE.

The FASB rule, which requires companies to track and disclose all of their leased assets, was initially earmarked for implementation in 2019 but was delayed by concessions granted to businesses following the outbreak of Covid-19, but these deferrals had expired by January 2022.

Enron and all that

ASC 842 came out of the financial fallout from Enron in 2001 and WorldCom in 2002.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBefore 2001, companies could exclude leases from their balance sheets. US regulators started to consider a change in lease accounting after the collapse of the energy and commodities company Enron, whose executives had kept significant liabilities off the balance sheet and, as a result, beyond scrutiny.

“At its height, Enron was a much riskier company than its published financial statements indicated in 2001. This was mostly due to its significant use of leases, which under the old leasing disclosure regulations (FAS 13 / ASC 840) only required capital leases on the balance sheet,” according to US software company Accruent.

“Infamously, Enron fell on hard times, entering Chapter 11 bankruptcy in 2001, exiting said bankruptcy in 2004, all before selling its last asset in 2006. Along the way, shareholders lost over $11bn, and the Sarbanes-Oxley Act of 2002 came into existence in an attempt to improve public firm disclosures and hold executives accountable. Enron’s accounting firm Arthur Anderson was dissolved, and the SEC [Securities & Exchange Commission] tasked the FASB to improve lease disclosures overall,” Accruent said.

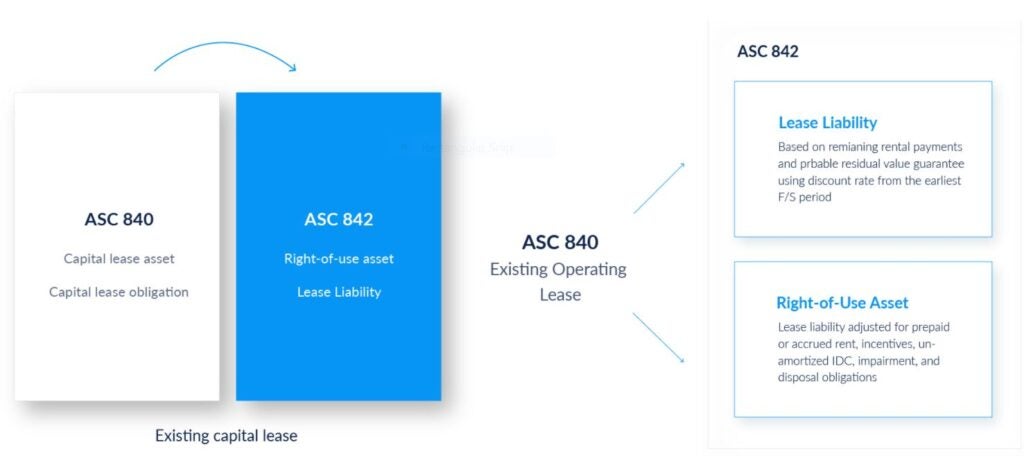

“One of the accounting loopholes the SEC identified was off-balance sheet operating leases. Under the ASC 840 standard, leases were classified as capital leases or operating leases. Capital leases were reported on the balance sheet. Operating leases were disclosed in the footnotes of your financial statements as “off-balance-sheet” operating expenses and excluded from important financial ratios, such as return on assets, that investors use to judge a company’s performance,” according to LeaseAccelerator.

Writing in the wake of the scandal when the accounting authority was considering reform of the existing rules, the New York Times cited Russell G. Golden, chairman of the accounting standards board, as saying: “The new guidance responds to requests from investors and other financial statement users for a more faithful representation of an organisation’s leasing activities.

“Under the new rule, companies must bring their operating leases onto their balance sheets. Operating leases give a company the right to use an asset, like a retail location in a mall, over time. Companies owe far more through operating leases than they do through capital leases, which are already accounted for on companies’ balance sheets. Capital leases typically allow companies to gain ownership of the asset at the end of the lease. Leases of less than 12 months will not have to be included on the balance sheet,” the NYT reported.

Todd Fredrick, chief executive at LeaseAccelerator, said: “The global economic environment has continued to be challenging. To manage the risk and uncertainty that goes with the growing challenges, taking control of lease portfolios and using automation to do more with less have never been more essential.”

Cost-benefit analysis urged for IFRS 16 leasing rules